#Mersal (whatever language that is), is a Tamil movie in which ‘sound’ economic principles have been mouthed. A newbie revolutionary – read an ageing actor – has found it fit to compare the GST rates in India and Singapore. He has also found, in his profound wisdom, that the hospitals provide free service in Singapore (Father, forgive them, for they know not what they say).

A nation’s income is through taxes. Salaried classes in India can’t cheat on their taxes as the tax component is deducted from their salaries. However, the entrepreneurs, consultants and independent workers, who are in the tax bracket, don’t have a standard tax deduction mechanism. This class tends to cheat, the main culprits being the real estate operators, rich farmers, independent professionals such as Lawyers , Chartered Accountants, Doctors, movie producers, movie actors and financiers. It is normal practice for this group to demand payment by cash for services delivered.

Now that we are in comparison mode, let us do it in full.

Comparison with OECD Countries:(ref: thehansindia.com)

- India’s tax to GDP increased from 10.4% in 1965 to 16.6% in 2015-16, the corresponding tax-to-GDP ratio of OECD countries increased from 21% in 1965 to 33% in 2015.

- Even compared to OECD nations with lower GDP (Korea, Turkey, Mexico, Chile, Portugal, Greece, Slovenia and Poland) India’s is still lower at 16.6% versus average of 24% of these nations.

- Among the G-20 Countries, India had the third lowest tax-base, just above Mexico and Indonesia.

- A high tax-to-GDP ratio is also a common feature of countries with high level of social security measures such as Belgium, Denmark etc.

- The level of tax compliance in most advanced countries is very high, as high as 90%.

The advanced countries ( in this case Singapore, Denmark) have severe penalties for tax avoidance and evasion. It is not possible to evade tax, especially personal income tax, in Singapore. But, if personal income tax increases, then there would be lesser incentive to earn more. This could cause productivity loss and income generation by individuals and corporates. Hence the Singapore government reduced the personal income tax from 40% to 15%. However, to make good the loss, the govt introduced the GST – Goods and Service Tax. This was a tax at the point of consumption and not at the point of earning.

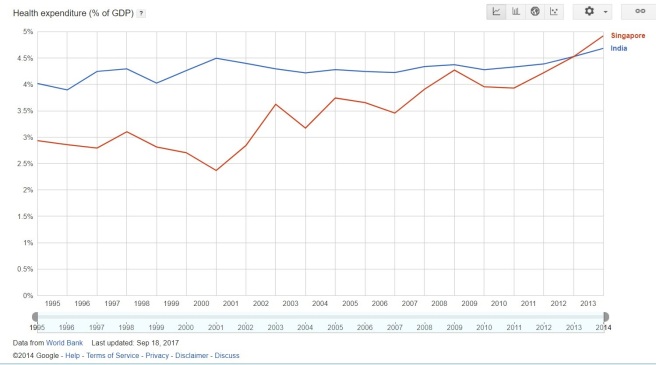

India’s income tax contribution to GDP is very less. This, coupled with an increased fiscal deficit (the difference between country’s revenues and expenditure) makes the government spend less on, say, health care or education.

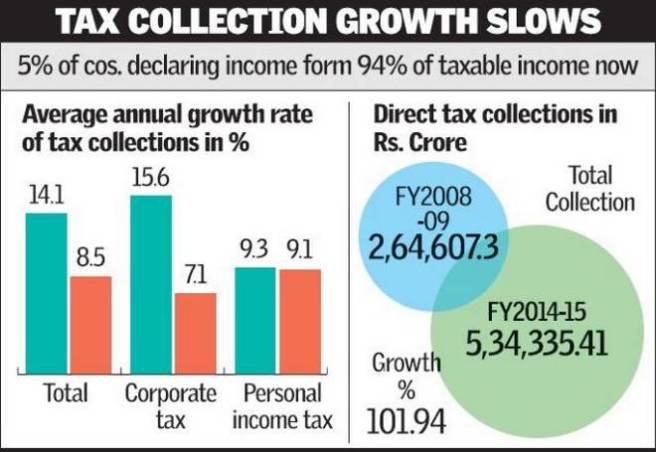

On 25-July-2017, Deccan Chronicle published a report that the number of India’s tax payers has increased – from 4 crore to 6.26 crore. Total population is 120 crores. Just 5.2% pay income tax.

So, people either pay taxes and enjoy benefits in, say, Singapore, or don’t pay taxes yet complain about lack of services – like movie actor Vijay – in India.

Now that this ‘intellectual’ has sought to compare, let us start with other parameters based on which comparison can be made. I have compiled most of these from from world bank data. Hence the data would not be fudged – like the income tax returns of movie actors.

Tax revenue as % of GDP

Source: Here

Income Tax in Singapore

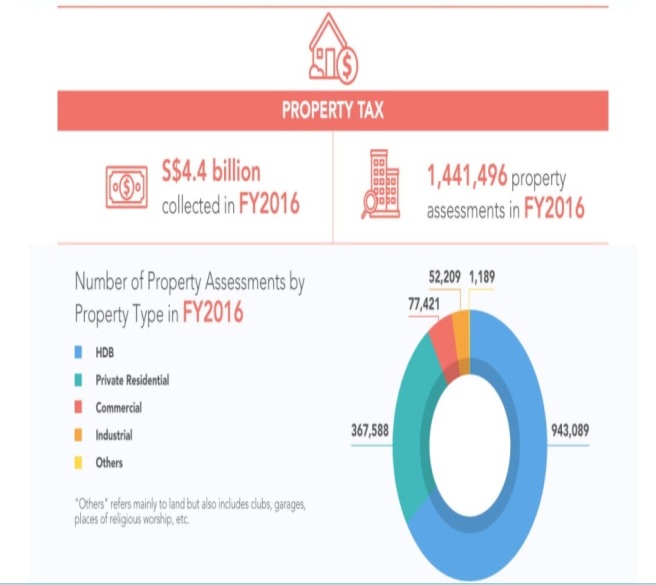

Property Tax in Singapore

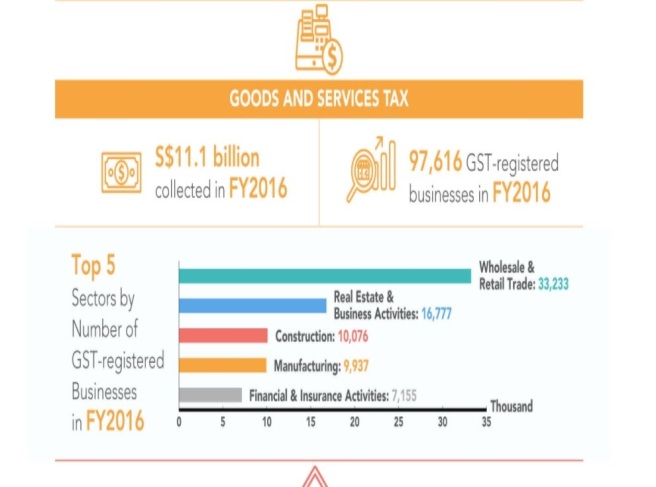

GST in Singapore

For a population of around 5 million and a GDP of USD 221 Bn, GST alone constitutes S$ 11.1 Bn. The revenue, not realized as income tax, is realized as a consumption tax. As there cannot be any evasion at the point of consumption, the GST in Singapore is serving its purpose and contributing towards nation building.

Source: Here

Health Expenditure ( % of GDP)

Source: Here

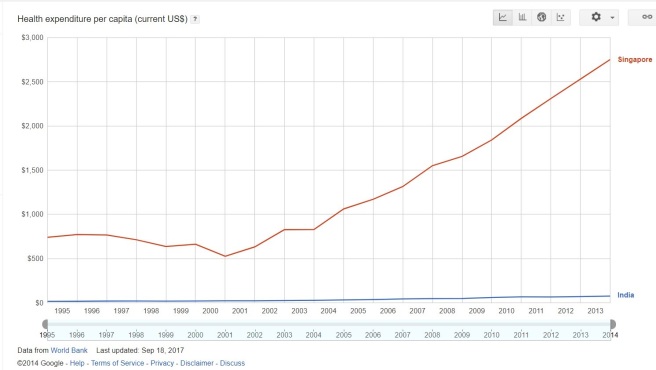

Percapita Health Expenditure (USD)

Source: Here

Let us take this case. GST collection is S$ 11.1 Bn which is approximately US$ 8.2 Bn. Let us extrapolate Singapore’s per capita health care spending as US$ 3000. For her 3.5 million citizens, Singapore would have spent US$ 10.5 Bn only. Thus GST alone would have helped offset the health expenditure for her citizens ( assuming health care is free, while it is not). The remaining 1.5 million people in Singapore are either Permanent Residents or foreigners. There is a differential medical cost for these two categories.

So, when a country introduces a tax regime, it is for a purpose – to serve its citizens.

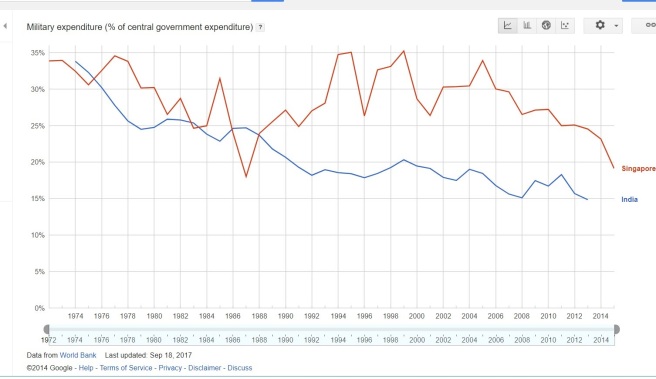

Military Expenditure as % of GDP

Source: Here

A casual look at the percentage spend on military would reveal many facts. Considering the land areas of the two countries, doesn’t this spend disparity strike the eye? Why does India need to spend less or Singapore spend more? Yes, it is true that both the democracies are surrounded by not-so-friendly neighbours. But does that justify Singapore’s spend?

Well, it does. Military spend, however high it might be, is one of technology acquisition. And that translates directly into military superiority. And Singapore needs this military superiority. Not that there is going to be an invasion in the near future, but that a nation should be confident of its military prowess. With a minuscule population, as a nation, Singapore needs to maintain its technical superiority. And that is financed by her taxes, GST being one.

When that is applied to India, ‘intellectuals’ begin their boil. Why?

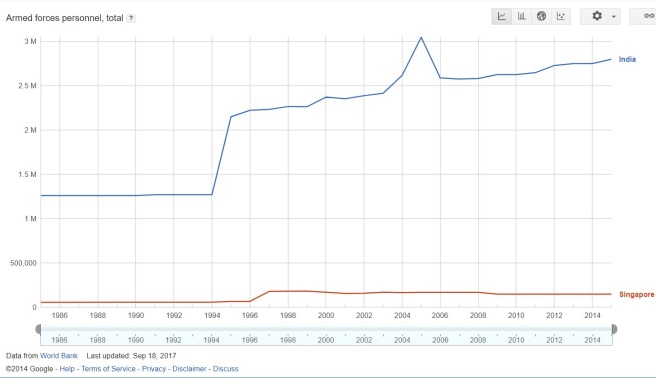

Armed forces personnel

Source: Here

Armed forces need to be paid. From where does a nation get to pay them, if not for the taxes that she imposes on her citizens? India’s border with Pakistan alone is 2900 KM. To stop infiltration by terrorists, India has built 150,000 flood lights mounted on 50,000 poles. What could be the cost incurred for just the maintenance of these lights? How about the border with China, Myanmar, Nepal and Bangladesh? Any guesses ?

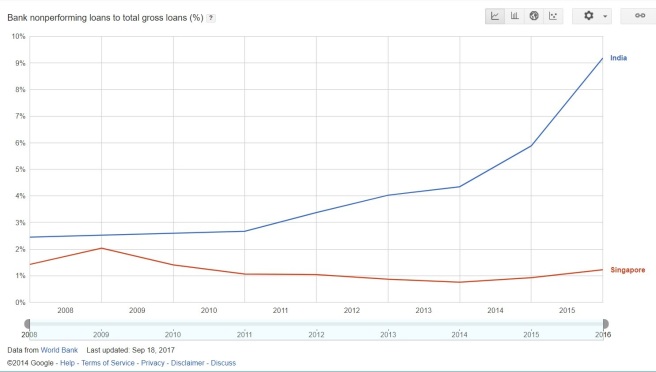

Banks NPA to Total Gross Loans (%)

Source: Here

Banks, predominantly state owned in India, have a higher NPA. Various factors such as mismanagement, interference by political forces, subsidy culture, frequent directions to waive loans off for political gains and the like have contributed to this NPA. Not that Singapore banks don’t have NPA. They do. But the banks are professionally managed, and with little political interference, they run as corporate companies that work for a profit while at the same time acting as an extended arm of the state in financing national growth. (Before I forget – How many movie producers and actors are yet to service their loans from state owned banks in India?)

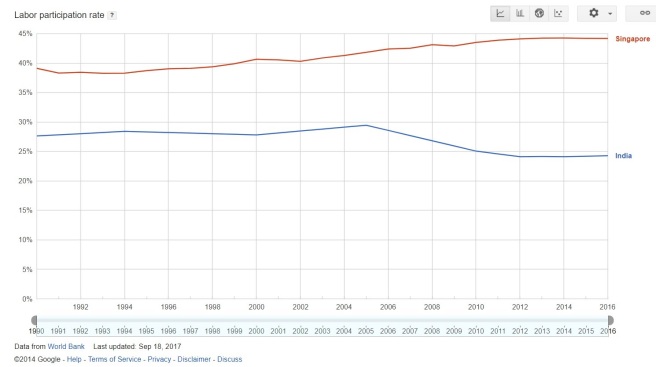

Labour Participation Rate

The proportion of the population ages 15 and older that is economically active: all people who supply labor for the production of goods and services.

Source: Here

44% of Singapore residents are economically active while, with such a huge population, less than 25% in India is so.

GDP per Person Employed

Source: Here

The contribution to GDP of each employed person in both Singapore and India paints a clear picture on the disparity of the situation. On the one hand the non-tax paying groups, hoarders, anti-nationals, foreign funded NGOs that seek to create disturbance combine together to pull the nation down, while on the other, the tax paying salaried class has to bear the burden of thefts, freebies and dole-outs in India. In this situation, how would the government get the resources necessary to ‘build hospitals instead of temples’ as the actor says?

Share of women employed in non-agricultural sector

Source: Here

Who stopped the Indian governments of the past from utilizing the women work force from contributing to nation building? Who was in power for around 60 years after independence? ‘Intellectuals’ should ask this question before questioning GST and advising on Hospitals.

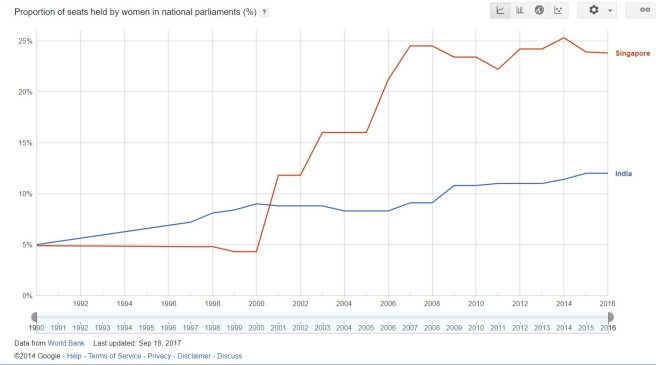

Proportion of seats held by women in Parliament

Source: Here

For all tall talk for the last 70 years, dynastic rule, prejudices and discrimination have ensured that women don’t have adequate representation in parliament. Only when women take to politics in large numbers would some balance prevail in the skewed Indian political scheme. And no additional marks for guessing who didn’t promote more women in politics (Clue: Who ruled the country for 60 years?)

Coming to wealth generation for the country: Singapore has two Sovereign Wealth Funds (Temasek Holdings and GIC). These companies invest Singapore citizen’s surplus CPF contribution and other surplus in overseas markets. Eg: Temasek has holdings in SingTel while the latter has a major stake in India’s Air Tel. When Air Tel needs money to expand in, say Africa, DBS Bank, another Singapore bank with connections to Temasek, could lend money. When Air Tel makes money, SingTel smiles its way to the bank while DBS Bank also smiles, which in turn benefits Temasek and in turn, Singapore. And she spends the money on her citizens -health care, road, rail, airport modernization et al. (Recently Temasek has sold its stake in Air Tel to SingTel).

Temasek to contribute to Singapore’s kitty.

It is the combination of state capitalism, better tax realization, professional management of government companies and a corruption free government that has resulted in better facilities for Singapore citizens. Anything else would have resulted in disaster.

India cannot have a sovereign wealth fund, for there is no surplus and there is always a deficit in her budget. And the reasons are as above. Leave alone overseas investments. A mere mention of LIC money getting invested in the domestic stock market leads to so much hue and cry in the Indian media. So forget sovereign wealth funds and overseas investments.

Note to Actor Vijay & his dialogue writer(s):

Before I close, a point to ponder. I hear you have mentioned about building temples instead of hospitals. Well, in Tamil Nadu, the government doesn’t build temples. It destroys them under a new name – HR & CE. Again, you can’t compare with what happens in Singapore. The Hindu Endowments Board, constituted by the Singapore government, owns properties, takes rent and administers temples in Singapore from the funds accrued. And it maintains the temples. Underline the word ‘maintains’. Here is a pointer from a government gazette notification.

Singapore is a country run like a company for the genuine betterment of her citizens. India has been run as a charity for 70 years, for the betterment of the different dynasties and their sycophants. Now, when a person tries to correct this anomaly, it would definitely be a pain for the history-sheeters, rent seekers, vagabonds, money launderers and communists. Teething pain, you see.

So, Actor Vijay – Before you sign up for the next Coca-Cola ad (after fighting for ‘water conservation’) or begin to mouth dialogues against taxation, read. Or am I asking for the moon?

References:

- http://www.business-standard.com/article/companies/temasek-investments-in-india-at-10-billion-117071500043_1.html

- https://heb.org.sg/wp-content/uploads/2017/01/HEB-Gazette-2016.pdf

- https://www.iras.gov.sg/IRASHome/Publications/Statistics-and-Papers/Tax-Statistics/#NewBookmark

- http://www.worldbank.org/

- http://www.oecd.org/

- http://www.businesstimes.com.sg/government-economy/temasek-to-contribute-more-to-govt-coffers

For more on Singapore, its founding and development, visit these:

A perfect rejoinder. Not only Actor Vijay gave wrong data and misled Tamilians, he antagonised practicing Doctors who had threatened for legal action as defamation. Actor Vijay & writer (half-boil) Attlee are in a big mess. The producer is ultimately lost.

LikeLiked by 1 person

1 its a movie. BJP, RSS, MODI is nowhere addressed. It says, imaginary story before movie starts.

2 many movies portrays, ministers and CM, govt officers are corrupt & they are villian in movies. In toilet movie, they say because of govt policy fault and corruption in implementing system, his wife died. Y dont u ppl object. (It received National award in same Modiji period).

3 if you feel offensive you can either charge censor board or dont watch the movie or make a movie with your thoughts.

4 let people decide if it worth making a creativity success or not.

5 if your party is so fond of Singapore like this movie makers, pass on lokpal bill.

6 In recent days, people die out of hunger, dengue. to divert people attention, you politicians picking issues with a big star movie to divert the attentions.

7 In Mersal movie he plays a hindu role and he is speaking with his hindu community addressing social issues (recomending to build Hospital) instead of temple. we hindus dont feel offended by that. if u felt u dont watch the movie and dont recomend this to your relations & friends.

8 for people data is not important, your data may say after GST and demonitisation our GDP increased. So ground level fact is important than data. people are affected by demonitisation, digitalization, GST and other taxation systems and thats true thats what shown in movie.

9 People knows the quality of treatment and education, they are getting from Govt provided schools & hospitals. We have a govt hospital in pondicherry, we call it hospital of Yemadharma ( people will die for sure if they got admitted) so, the movie is true.

Sorry for typos.

LikeLike

Sir, you missed the point. My analysis is on tax structures and other economic indicators of two countries that have supposedly been compared in the movie.

LikeLike

Controversial Stupid star Smriti Irani allotted important portfolio by PM Modi and in future kindly avoid bad words about opponents of NaMo economic policies. GST rates are quite exorbitant. For bank service charges around 18%GST including postal services like Speed Post,Registered Post,courier etc attracts 18% GST is badly affects even Com on Manon the road. Your support to NaMo economic policies Insensitive to Common man’s hardships due to high GST rates imposed without applying common sense. TN BJP leaders arrogant speeches due to brutal majority in the capital. BJP vote bank in TN is strictly speaking lesser than TTV lead AIADMK wing.

LikeLike

I have written an analytical report, backed by data, on the taxes in two countries. I have not supported anybody. Pl be analytical in your review.

LikeLike

GST is not NaMo’s baby. It was cooking for 27 years. NaMo as Gujarat CM opposed it. So, your contention that one man trying to change shows your bias. On what basis, Prior to GST{ 4% VAT plus Service tax of 14.33% on 40% of the cost of food items} is equal to 18% GST on food items in hotels? India is not seeing development from 2013. Listen to Sushma Swaraj’s speech in UN.

LikeLike

UPA brought the Indo US Civilian Nuclear deal. BJP opposed it for the sake of opposing it then. Now that they are in power, should they abandon it? What kind of an argument is this? GST is at the consumption end. At the income end, direct tax realisation is dismal compared to the population. Any reasonable country would do this. If GST should not be imposed, let us have an income tax of 55% like some Scandinavian countries. In that case will all businessmen start paying taxes? The question is not about my biases. It is about a taxation and economic KPI comparison between two countries.

LikeLike

I never said GST is not needed. It is the shoddy implementation. Don’t you see the illogic of the tax rate in dishes you consume in the hotels? what should have been around 9% (4% VAT plus 14% on (40% of Cost Price)) is actually 18% now. GST is for rationalization of slew of taxes and not a mode to continue to collect the same level of tax prior to GST. The problem is that Govt ensured tax collection and conveniently forgot to rationalize the taxes.

You do agree that BJP opposes something when convenient and adopts the same and usurps the credit for it too when in power. Thanks for being in agreement.

If you had confined your narration to only data comparison and not made statements showing your bias, why would we comment on it? We wish your good data comparison leads to competent authorities comparing the services & quality provided by developed countries and deliver the same to us too.

LikeLike

The ruling party is, yet again, another political party. They do their politics, no doubt. But this GST is a long pending item. Any advanced country would need to have one nation – one tax regime. India is moving towards that. If there are tax anomalies or of something needs an arbitration, approach the Govt, your legislators by all means. If not for this, what are they for? To stay in resorts and while away the time as they did in Chennai? So, ask them to speak in parliament, select committees and the like. Additionally, propose alternative taxes or other revenue generation mechanisms. A good Govt would pay heed to the people. As responsible citizens, it is our duty to point the details to the elected reps. By all means do so. Drown them with facts and data. The Govt is bound to listen. If not, vote it out. But then, beware of the choice. Do you want another 10 years of 2-G, Coal, Aadarsh et al?

LikeLiked by 1 person

Thanks for your reply to. GST haunts rulers now they forced to take corrective actions due to Gujarat election fever. Bania community totally angry with Bania Janatha Party due to GST high tariffs.

LikeLike

All said and done, the point is — Actor J.Vijay gave wrong data for GST. Under sensationalisation, he did politics with lies. This is proved in this blog. That’s it.

LikeLike

Singapore pay back To its citizen as Singaapore Share lowest $1200 to $2400 after GST introduced annually. First Go for 3% after 2 years go for 5% and Now 7%. When introduced they give certain amount of vouchers to low income citizen. Hypersuper market absorbs initially that 3%. While introduce

GST starting itself 28% very high.

If you’re self compare country to country compare top to bottom level.Leaders also be need to be good model.

LikeLike

Dear Sir, you have missed an important point. We understand only Service class pays taxes and Business only have fun to manipulate taxes or not paying them. Here, in this case, the GST tax is getting build into the cost of the product /services, so that consumers ultimately pay the Taxes. Thus in the end again the consumer (common man) is the sufferer. Did the great Human beings think about how they would implement these changes without increasing the cost of goods. Ultimately Govt is only interested in getting its coffers filled.

LikeLike

sir, tax at income doesn’t work in India. That is why there is a tax at consumption. The more you consume, the more you pay. The same model as that of Singapore. While Singapore has reduced income tax, India has not, yet. However that doesn’t matter as the income tax paying class is minuscule, anyway.

LikeLike

And as you said only middle class pays income-tax so why burden them again with It?

LikeLike

That is cool. So like Scandinavian countries, should the Govt hike the income tax to 55%? I think the Govt should do away with income tax altogether and impose only consumption based tax. That would offset the anomalies.

LikeLike

As we are not accustomed to pay taxes, trained well in evading taxes, well trained in unaccounted transactions , now feel hard to go by rules. More over Mr Modi has been projected as anti Secularist !

Most of Indian mentality is not on the welfare of the nation, but on their own. The dream of Modi is to make India the greatest nation in the world, which is least cared by his opponents as well as the people of India.

LikeLike

Well said. The media plays into true hands of the secessionists, evangelists, communists and anti-nationals, for they have an onerous task to complete – destroy the nation. As right thinking citizens, we have to show the spotlight in the areas not covered by the mainstream media. One such is data based journalism. More to follow.

LikeLike

a state in which citizens belive that film actors are worshipped even by gods any amount of logical explationis a wasre of energy.yatha praja thatha raja

LikeLike

True. Sad state.

LikeLike